[ad_1]

ONCE again, recession concerns were back in the spotlight after banking issues in the West sparked fears regarding further tightening of credit conditions. This re-ignited a fierce flight to safety as investors rotated back to defensive assets in a bid to de-risk.

Consumer staples stocks were one of the top choices for many, being a haven asset that has historically shielded against waves of drawdowns and volatility.

With a recession as our base case, the US Consumer Staples sector remains one of our favourite defensive plays. Since our call in December, the sector’s performance has been relatively stable, even during the market hysteria in March.

We continue to maintain our positive view on US staples as a haven to provide shelter from the impending storm. In this article, we outline the reasons why we grow increasingly confident in our call.

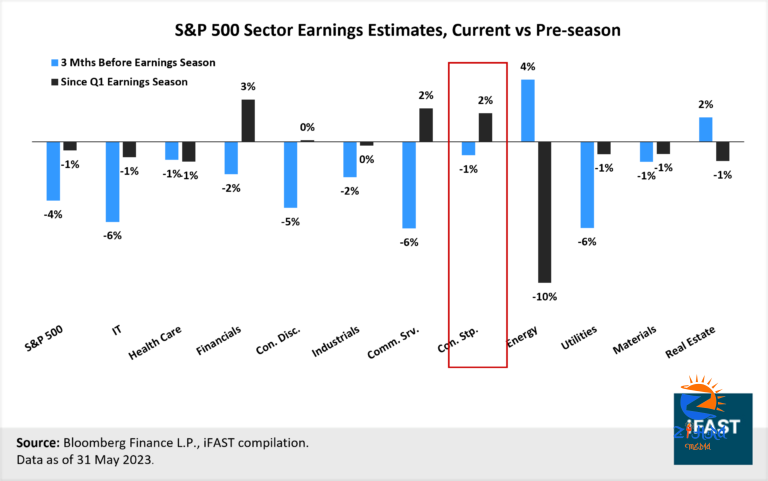

Chart shows staples was rewarded with EPS upgrade at a time where most sectors saw EPS cuts.

Table shows companies are intending to either carryover higher pricing or increase price further in 2023.

Earnings season highlights fundamental strength amidst tough times

This earnings season has so far been great for US consumer staples. With around 84 per cent (31 out of 37) of the companies having reported, the sector is tracking a 6.5 per centearnings beat and a 1.7 per cent sales beat.

Entering the earnings season, analysts have projected a 2.5 per cent yearly earnings decline in 1Q but EPS has exceeded expectations and instead, is on track for a 7.3 per cent y-o-y growth.

At a company level, the majority have beaten analysts’ earnings estimates, with only four failing to do so. Most large companies, like P&G, Coca-Cola, Pepsico, Walmart, Target, and Mondelez have beaten both earnings and sales estimates.

With the better-than-expected earnings result, staples were rewarded with earnings upgrade at a time where most sectors were hit with earnings cut. That said, earnings estimates for staples held up well even before the current earnings season.

In the three months prior, since the previous earnings season, the market (S&P 500) was hit with a four per cent earnings cut while staples only experienced a one per cent. In sum, the sector’s good earnings result and strong earnings revision point to resilient and better-than-expected fundamentals, entering a growth slowdown.

Table shows product elasticities remaining resilient and below historical levels despite companies raising prices.

Table shows prices for crop-based, animal-based, energy, and packaging moderating in recent months.

Sturdy top-line growth in a challenging macro backdrop

Similar to last year, higher prices and strong pricing power will continue to be the dominant driver of topline growth moving forward. In line with consensus expectations, we expect positive sales growth this year, despite a challenging macro backdrop.

We think this is hard to disappoint as sales volume would have to decline significantly to offset price hikes, which is unlikely given the resilient consumer demand and low price elasticity.

As macro growth slows, we believe staples will be one of the few sectors offering sturdy top-line growth.

Chart shows transport costd decelerating as supply-chain bottlenecks ease.

Chart shows expectations for gross margin for the staples to rebound from 3Q23 onwards.

Expect further price increases

Higher selling prices have been a key revenue driver over the past quarter while volume moderates.

Across the sector, most companies have raised prices to combat higher input costs and operating expenses, driving the increase in sales. This year will be largely indifferent, we expect two types of pricing: more price increases, albeit at a more moderate pace and magnitude; or a carryover of last year’s higher prices.

Either way, prices are unlikely to be rolled back this year and should increase year-on-year.

We looked at a group of 13 consumer staples companies, each with a significant market share within their sub-industry, to gauge the price response for the sector this year.

Based on the recent earnings season, majority of the management teams have planned for further price hikes in 2023, with milder increments than the prior year.

This includes companies like Mondelez and Coca-Cola which have already raised prices significantly. The other group of companies like Pepsico, Walmart, and Kraft Heinz, have decided to pause hikes and carryover last year’s prices, which remain higher than pre-pandemic levels.

Table shows that staples has historically performed well 12 months before and after the recession.

Pricing power remains strong despite higher prices

With further planned price hikes this year, pricing power remains the focal point. We believe most companies still retain their strong pricing power despite multiple rounds of price hikes. First, price elasticity remains resilient for many product segments (Food, beverages – alcohol and non-alcohol, tobacco, and household products).

Low price elasticity allows companies to raise prices without materially damaging demand. Based on the 13 companies we tracked, management teams have broadly highlighted that product elasticity is still low in general. While it varies from product to product, the common trend is that elasticity is holding below historical levels.

Second, consumer demand remains strong across most products. To be clear, we anticipate some softening of demand given macro headwinds but relative to discretionary goods, we expect more resiliency.

The ongoing consumer trade-down of moving from pricier, premium goods to cheaper, value-for-money goods trend has supported sales volume for many companies. For example, Walmart reported strong share gains in grocery, with nearly half coming from higher-income households as customers prioritise value.

At the same time, across companies, we see an ongoing increase in marketing/ promotion efforts to strengthen brand equity and market core products as a value buy. This will take time, but successful campaigns could create stickier demand going forward.

Potential recovery is in sight

Cost inflation was a key driver of margin degradation over the past year. Higher input prices have eaten away at gross margins of companies that are not able to swiftly and significantly pass over these costs via pricing.

That said, several contributing factors of cost inflation have declined in recent months.

Based on our tracked commodities, prices for energy and key packaging materials (i.e. aluminium, steel, zinc, and plastic) have declined notably year-on-year, while animal and crop-based ingredients saw broad-based declines.

Transport cost have also decelerated as supply-chain bottlenecks ease. Freight rates of truck, air, and sea transport services have all moderated, based on US producer price index data.

While commodity prices may remain elevated going forward, the recent moderation in prices allows companies to secure commodity hedges at better rates, either by adding more hedges or when existing ones rolled over. This should soften the impact of commodity inflation going forward – for both hedged and unhedged cost. Similarly, transport costs have also subsided significantly over recent months. Assuming further normalisation of supply chain, we should see moderating freight rates in the back half of the year.

While these two cost drivers have eased, other costs such as labour are expected to stay elevated, a pain point outlined by various management teams during the recent earnings season. Labour costs may remain elevated, but absent a strong increment, we believe the easing of commodity and transport costs points to an alleviation in cost inflation for staples, albeit in a gradual and non-linear manner.

With cost inflation softening and top-line growth remaining sturdy, we expect gross margin pressure to ease, setting up for a potential recovery in the coming quarters. Analysts expect this rebound to happen from 3Q23 onwards based on gross margin forecasts, suggesting firmer fundamental support moving ahead.

The potential for a margin recovery is also echoed by many management teams lately. Most highlighted that the negative impact of inflation tends to first weigh on a company’s bottom line.

However, a company’s responses to high inflation, such as higher pricing and productivity improvements (which leads to cost control), and their respective impact tends to lag. Only recently, have these positive impacts caught up and are reflected across the earnings of companies.

Consumer staple a harbour in the equity storm

With a recession as a base case, we expect conservative but positive earnings growth of six per cent this year, followed by a nine per cent rebound in the subsequent year.

Applying our designated fair PE ratio on EPS projections, we project an upside potential of 26 per cent for the sector by end-FY25. While the upside might not be comparable to growth sectors such as IT or Consumer Discretionary, we think the defensive attributes of staples should mitigate significant downside risk this year, making the 26 per cent attractive from a risk-reward standpoint.

As such, we are reiterating our positive US consumer staples call given resilient fundamentals, upside on margins, and good track record as a safe-haven play. For investors who wish to seek exposure to the US staples, we recommend the Consumer Staples Select Sector SPDR Fund.

Within the sector, we prefer companies with resilient fundamentals, including strong pricing power and the ability to re-grow margins. We like global beverage leader, PepsiCo, and global snacks giant,Mondelez International.

These two companies have strong brand names and large market shares in their respective areas, affording them strong pricing power even in a challenging macro backdrop. Gross margins of both companies also look well-protected, with potential upside, due to strong pricing power, high carryover prices, and effective cost control.

[ad_2]