[ad_1]

SINCE the reopening of international borders in April this year, transactions in the Johor property market have been off to a good start.

In spite of the uncertainties brought about by macroeconomic factors and the elections, KGV International Property Consultants (M) Sdn Bhd director Samuel Tan is hopeful that the steady trend so far will continue until the end of the year.

“There are many buyers that are adopting a ‘wait and see’ approach, pending the outcome of the elections.

“The total volume and value of transactions are expected to be marginally higher than the preceding quarter and certainly much higher than the previous year’s corresponding quarter, due to the low base then,” he tells StarBizWeek.

Tan is hopeful that sentiment post elections will be positive, but adds however that the increasing cost of borrowing and high inflation rate could hamper the market.

CBRE|WTW in its property market performance for the first half of 2022, says the Johor property market may show further improvement towards year-end.

It adds however that concerns about affordability, job security and economic instability may dampen sentiment.

“Rental demand is also expected to rise following more Malaysians either resuming or joining the labour market to-and-from Singapore.”

Knight Frank Research in its Malaysia Real Estate Highlights report for the first half of 2022, says the high-rise residential segment in Johor Baru continues to remain lacklustre due to the oversupplied market and lack of demand. “In contrast, demand for landed residential properties, especially those located in established areas and upcoming suburbs with good connectivity, remains strong post pandemic.

Knight Frank also says the recent hike in interest rates may dampen the property market, especially in the residential segment.

On the mend

Tan believes it may take a while for the Johor property market to fully recover back to pre-pandemic levels.

“I believe it will take another year before conditions improve. Hopefully, there will not be any black swan incidents which may disrupt this expectation.

“The important thing is to adapt to these changes and realise that property investment is a long-term game.

“It is less consequential if the purchase is for our own use. Speculation is not encouraged when the market is uncertain and the property is suffering from some indigestion.”

Tan expects the ongoing headwinds to continue at least until the first half of 2023.

“Hopefully by then, the interest rate hikes will wane off and inflationary pressures will be lower.

“Political certainty with sound and long-term policies, especially on property-related matters, will cool nerves,” he says.

Tan adds that various stakeholders need to come together to find new and better economic catalysts to spur the market.

“As a nation we must remain competitive, especially against our neighbouring countries.

“There is a need to relook into our education system and human resources. We must produce graduates with high skills that can be easily absorbed into the labour market.”

According to the National Property Information Centre, the residential property sector recorded 116,178 transactions worth RM45.62bil in the first half of 2022, which was an increase of 26.3% in volume and 32.2% in value year-on-year.

Johor recorded the highest number of new launches in the country, capturing nearly 23.8% (2,509 units) of the national total with sales performance at 31.8%.

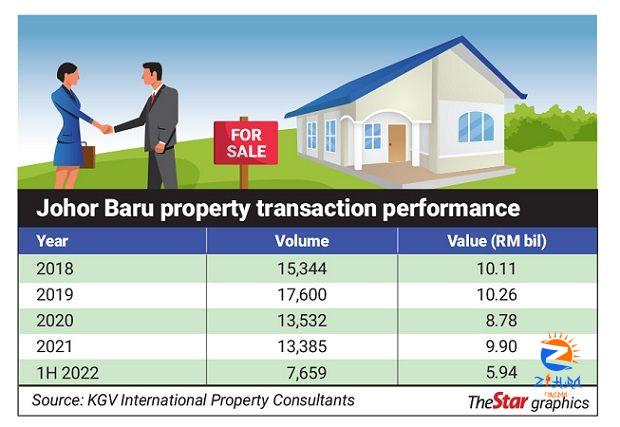

For Johor Baru itself, transaction volume stood at 7,659 units valued at RM5.94bil in the first half of 2022. Transaction volume in Johor Baru stood at 13,385 units valued at RM9.9bil for the whole of 2021.

Tan says transaction volume and value performance so far this year has been encouraging.

“The reopening of borders since April certainly helps in reconnecting Johor and Singapore. Although it started slowly, it helps to restore confidence.

“Prospective buyers were able to view properties rather than to buy virtually. The ability to see and touch is important to convince them that it is a good investment.”

Tan says developers were busy clearing unsold stocks, especially for high-rise units.

He adds that landed residential properties priced below RM700,000 have been faring well.

“But this will be a challenge moving forward as we see an increase in the cost of building materials, land and labour, apart from more compliance from the authorities.

“Nonetheless, we are off to a good start.”

Knight Frank also says the reopening of the country’s borders has bode well for the gradual recovery of the tourism and retail related markets.

“A high number of visitors enter Johor daily through the Singapore – Malaysia Causeway, one the busiest border crossings in the world or via the Tuas Second Link.

“The improving footfall in shopping malls is positive for the state’s retail market.”

It adds that the office market in Johor Baru continues to gather pace following normalisation of economic activities, with more leasing enquiries anticipated moving into the second half of the year.Separately, Knight Frank says the industrial sub-sector remains the bright spot in the state’s property market.

“Workers’ housing is emerging as an alternative asset class in the industrial market due to enactment of the Employee’s Minimum Standards of Housing, Accommodations and Amenities Act 1990 (Act 446).

“The market for workers’ housing is expected to grow rapidly due to robust demand and scarcity of supply.”

Knight Frank says work on the on-going Johor Baru – Singapore Rapid Transit System (RTS) project is progressing well, circa 17% completion to date.

“Besides ensuring a smoother entry to Johor by alleviating traffic congestion along highways, the RTS will generate shared economic and social benefits when fully operational by end 2026.

“It will be a catalyst to spur further development activities in Johor Baru and its surrounding areas.”

[ad_2]